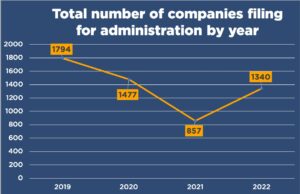

A total of 1,340 UK businesses filed for administration in 2022 – a 56% increase compared to 2021.

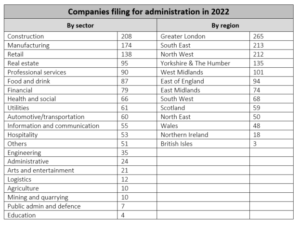

Recent data from The Gazette Official Public Record has revealed that construction, manufacturing and retail were the sectors worst hit, accounting for 39% of administrations. Greater London led the way with 20% of the filings, followed by the South East and North West (16% each).

While January (55) was the quietest month, administration numbers leapt to 160 in November – the most recorded for 28 months – before dipping to 120, 93 and 104 in April, May and June respectively.

And while administrations are still yet to hit pre-Covid levels (1,794 in 2019), recession fears and the financial pressure on households and businesses means the worst is still yet to come, an insolvency and restructuring expert has warned.

What does the future look like for UK businesses?

The latest statistics show that the true costs of living and doing business are beginning to bite. Numerous headwinds – such as the cost of borrowing, and increasing energy, fuel and raw material costs – have become a new normal at this point and businesses are being pulled from every direction. Furthermore, while supportive in the main, pressure from lenders is increasing and HMRC is taking a firmer stance, seeking to cap levels of liability for non-payment of tax.

While the UK is perilously close to recessional phase, businesses must have a clear focus on cash flow and look to save costs where possible. Directors must continue to plan strategically for the ever higher costs of ‘doing business’.

For businesses to survive longer term, they will need to act now to address underlying issues. It is important to get to grips with matters at the earliest possible juncture and to take the appropriate professional advice, if needed. Taking a proactive approach will provide options and help to keep businesses afloat.

If things continue as they are, we can expect to see an increase in businesses failures as they battle tough trading conditions. However, resilient businesses with a strong balance sheet and with the right planning and oversight in place, may well find opportunities for growth as we head further into 2023.

If you’re facing financial difficulties, or would like some advice with helping to identify areas of business stress and distress as early as possible, our team of experienced insolvency solicitors can help.

Get In Touch

Andrew works with companies, insolvency practitioners and lenders on restructuring and turnaround options. He also advises on formal insolvency issues including the sales of assets and undertakings, validity of security/appointment, asset realisations, director’s conduct and antecedent transactions.

How We Can Help

Our Latest Litigation Dispute Resolution Updates

24 Feb

Corporate Restructuring & Insolvency

Administrations up 56% in 2022

20 Oct

Corporate Restructuring & Insolvency

Midlands law firm supports Bensons for Beds’ Eve Sleep buy out

23 Nov

Corporate Restructuring & Insolvency

Rising energy prices force Bulb to enter Special Administration

27 Oct

Corporate Restructuring & Insolvency

High Court highlights the risks of drawings in lieu of salary

Our experts are here to answer any questions you might have

If you’d like to speak to a member of our team, please fill out the enquiry form. We will aim to reply to your query within 2 hours

Need to talk to someone sooner? You can call use at the number below