On 23 September 2025 the energy regulator Ofgem published the winners of the first round of potential projects aiming for funding in the first round of the long duration energy storage (“LDES”) cap and floor scheme. Of 171 applications received, 77 projects satisfied the eligibility criteria and go through to the next stage.

Purpose of LDES scheme

The LDES scheme was launched for applications back in June and is designed to bring to market schemes that will store surplus intermittent renewable energy. One of the key ambitions is to maximise renewable energy on the system and reduce constraint costs, which are the monies paid to wind and solar farm operators to stop generating on particular windy or sunny days. By storing this power instead, it can be used later when the weather changes, and this will contribute towards a clear, more efficient and secure energy system.

LDES also has the advantage of being flexible, which means it can participate in balancing markets, and a strong domestic storage industry offers the prospect of the UK being able to export storage capacity as well as technologies.

Long duration

It’s been some time since LDES schemes were last bult in Great Britain. We currently have 2.8GW of LDES across four pumped storage hydro schemes in Wales and Scotland, which operate like batteries, storing electricity by pumping water from a lower lake up to a higher one, and then releasing that water back down to the lower lake through turbines when electricity is required.

Whilst power can of course be stored by batteries – and there are now many grid-scale battery systems in operation across the country – LDES is focussed on systems which can store and release electricity for long periods, defined as eight hours or more.

LDES schemes currently under development include liquid air energy storage and compressed air energy storage, as well as Li-Lon and flow batteries.

Cap and floor

This current cap and flow scheme is designed to provide financial support to LDES schemes and is based on the model that has been successfully used for electricity interconnector projects. Crucially, it offers a 25-year contract, which provides a minimum revenue for the project (the ‘floor’), such that if project revenue falls below this floor, then consumers (via a levy on electricity bills) will make up the difference to the floor level. The quid pro quo is that there is also a maximum revenue limit (the ‘cap’), set as a fair rate of return on invested capital; if project revenues exceed that cap then the developer pays the surplus to consumers.

Eligibility assessment

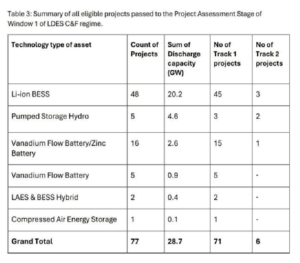

The application window for the LDES scheme first round was opened by Ofgem on 8 April 2025, and 171 applications were received. Each application was assessed using seven eligibility criteria, and 77 applications were judged to have met the criteria and move to the next stage, which is detailed project assessment. As can be seen from the table below, the majority of eligible projects were long duration Li-ion BESS projects.

The submissions which failed were typically judged to have shown insufficiently clear funding strategies or costs, or insufficient detail on delivery times, or gaps in technical document (such as minimum discharge duration).

Next steps

The next stage, an eight-week project assessment, will take place in Q4 2025, with ‘initial decision list of projects offered a cap and floor’ published in Spring 2026, and with final decisions on awards expected in summer 2026. Projects will be evaluated on their economic, strategic and financial merits, with no predetermined weightings.

Alongside the eligibility assessment outcome described above, Ofgem also published last month a number of related documents:

- Ofgem’s decisions on project assessment and the Multi-Criteria Assessment (MCA) Framework, setting out how projects will be analysed;

- the Cost Assessment Guidance, explaining how Ofgem will assess project costs, not only during the project assessment stage but through the cap and floor contract duration;

- the Financial Framework for the C&F regime, setting out Ofgem’s decisions on financial elements of the cap and floor scheme; and

- NESO’s Cost Benefit Analysis, explaining how NESO will undertake market modelling to support Ofgem’s MCA decisions, as well as information that eligible LDES projects will need to provide for the next project assessment stage.

This outcome is encouraging, as long duration storage undoubtedly has a role to play in the net zero transition. But with long duration Li-ion BESS projects the main winners here, and with further rounds likely to follow in due course, we may need to wait until we see a greater emphasis on this cap and floor scheme supporting emerging new technologies.

This content is provided for general informational purposes only and does not constitute legal advice. It is not intended to address the circumstances of any individual or entity, nor should it be relied upon as a substitute for specific advice from a qualified solicitor. The information reflects the legal position as at the date specified and may be subject to change. If you require advice on a specific matter, please contact us directly.