The detailed technical methodology of evaluating bids is one of this overlooked areas of procurement for procurement lawyers. The Public Contracts Regulations 2015 (“PCRs”) do not detail any specific methodologies and only provide that the contracting authority must ensure that the methodology and weightings must be fair and transparent. This means that the authority has a degree of flexibility in its price/quality evaluation model. The PCRs provide that the contract must be awarded on the basis of the most economically advantageous ender (the “MEAT”). The MEAT may be identified on the basis of:

1. price or cost alone, using a cost-effectiveness approach;

2. a price-quality ratio; or

3. fixed price or cost so that bidders compete on quality only.

In evaluating price, as part of assessing the MEAT, contracting authorities invariably use a relative price-scoring methodology. This common “cheapest bid/ other bid” methodology, as set out on the Crown Commercial Service’s Digital Marketplace. The lowest price gets the highest score, and each of the other prices are marked relative to the lowest priced bid as follows:

Fixed quotes

To score fixed price quotes, you must divide the cheapest quote by each supplier’s quote.

Example:

supplier A’s quote is £15,000

supplier B’s quote is £10,000

supplier C’s quote is £30,000

To calculate a score for supplier A, divide 10,000 by 15,000. Supplier A scores 0.667.

To calculate a score for supplier B, divide 10,000 by 10,000. Supplier B scores 1.

To calculate a score for supplier C, divide 10,000 by 30,000. Supplier A scores 0.333.”

The issue of relative price-scoring has been considered and subject to public debate in the procurement-nerd community for some time. But as long as this was normal market practice and was endorsed by the UK government guidance and approach, then it was probably fair to say that there was relatively little risk that this would be challenged – this was acceptable market practice and therefore, not unreasonable. In addition, the mathematics was pretty simple and, therefore an attractive solution for everyone involved, including, especially, the lawyers.

However, the UK Government published guidance last year which means that this approach is no longer acceptable. The guidance provides:

“Relative price scoring should be treated with caution and not be used unless there is a specific business reason which has been approved by the commercial lead and the project SRO.” (para. 7.2.1)

The Government Commercial Function has proposed, instead, benchmark scoring and scoring on the basis of value for money ratios. Using ratios certainly makes sense from a regulatory compliance perspective: the PCRs refer to the pretty much overlooked “best quality-price ratio”, rather than, for instance, best quality-price score.

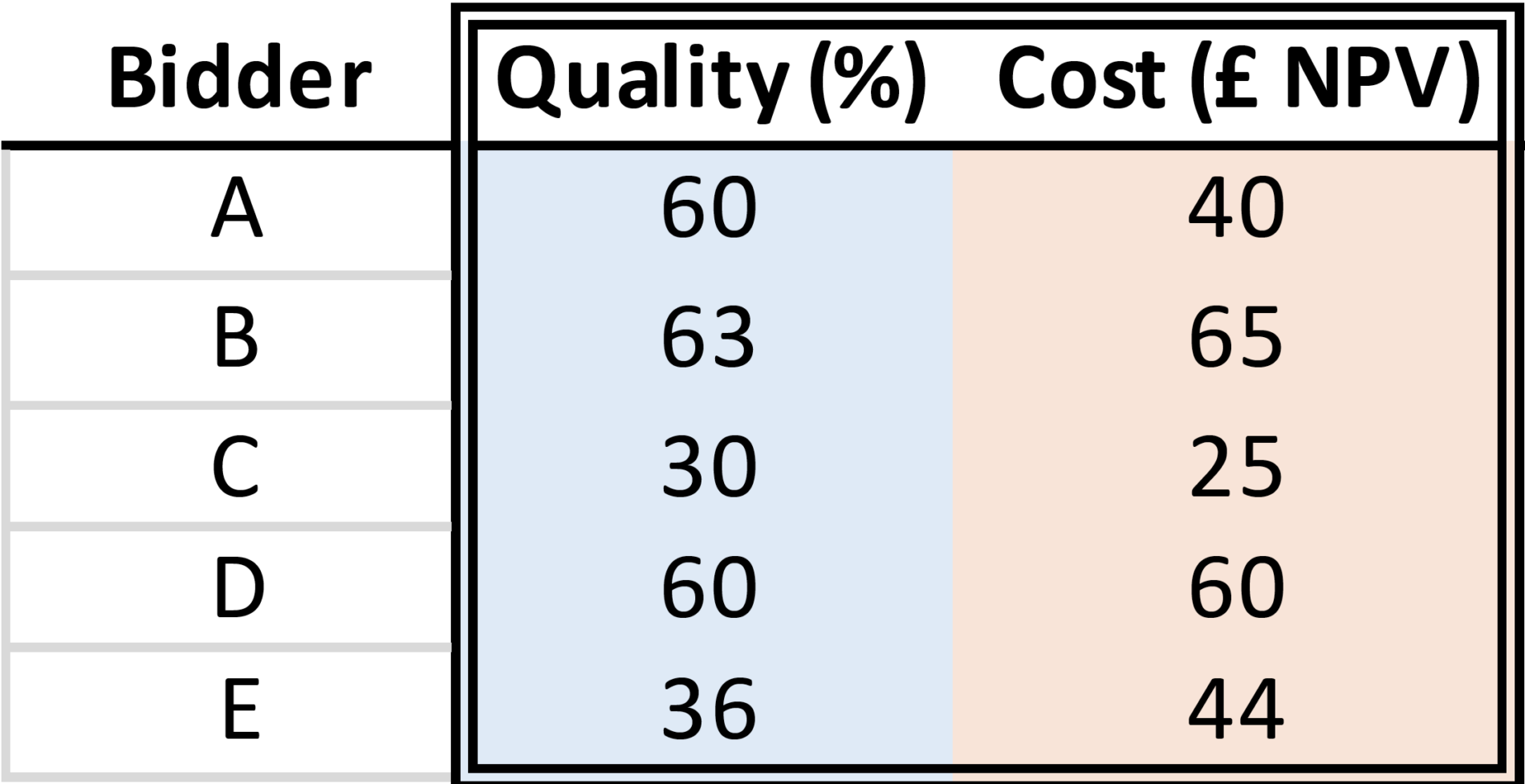

There is some quite interesting mathematics around using ratios, as against relative price scoring. Assuming the following five example bid scores, where the quality/cost weighting ratio is 50: 50:

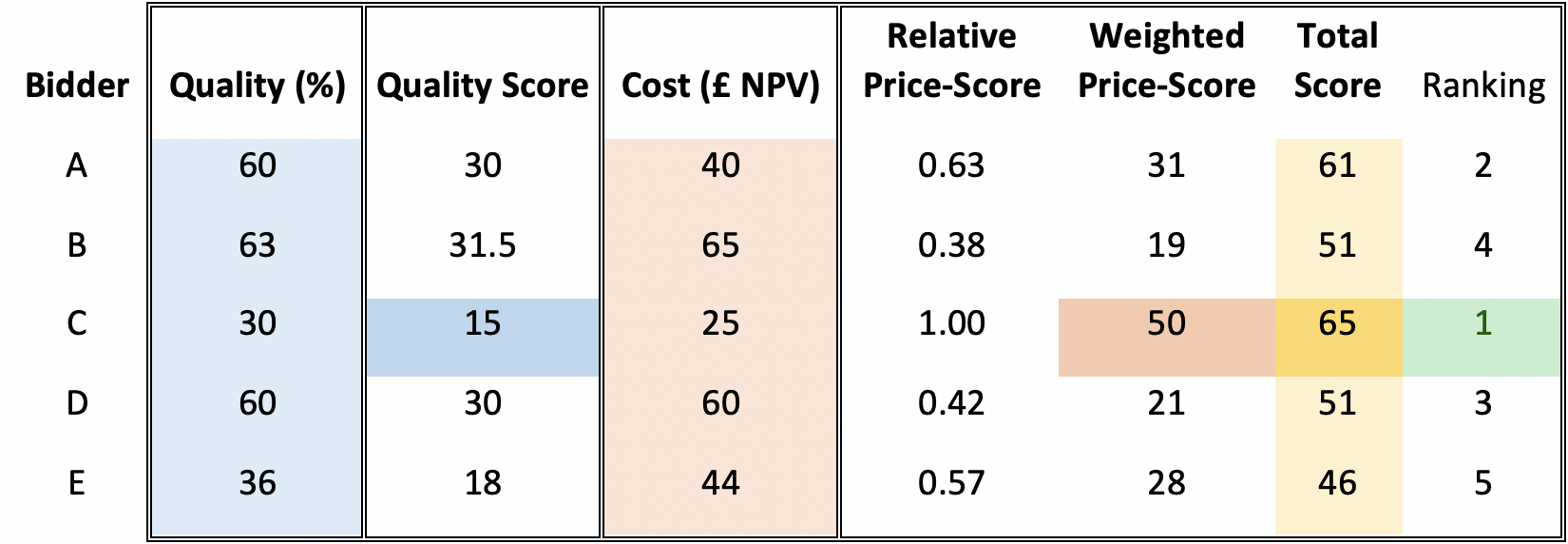

Using the relative price-scoring methodology, Bid C is the lowest price, as set out in the table below. Bid C scores 30% (i.e. 15 points) on quality and scores maximum of 50 points on price, and therefore wins (i.e. 50 points on price, 15 points on quality):

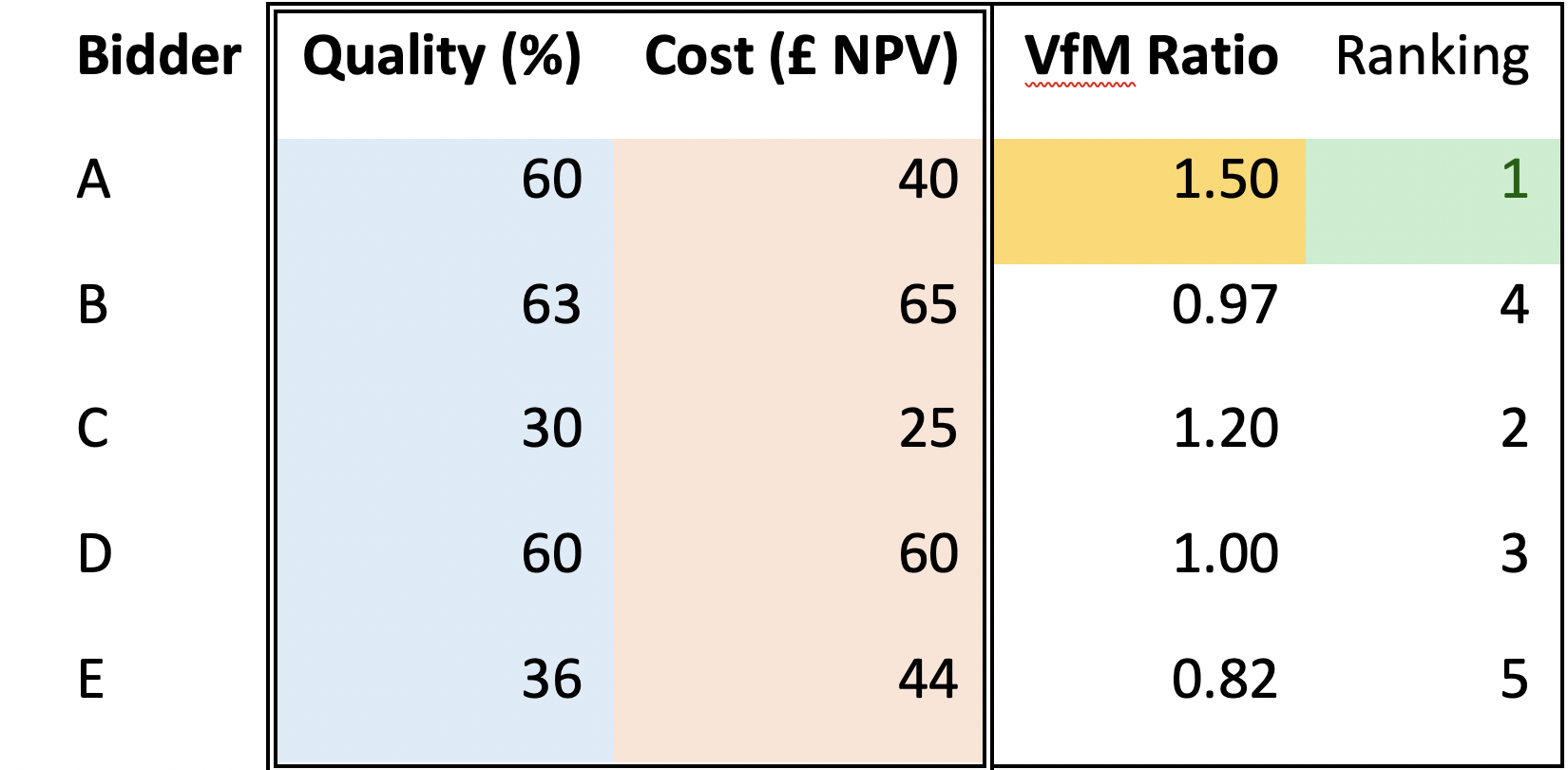

By contrast, under a quality-price ratio model, Bid A wins. This is much more logical, based on the weightings, and intuitively correct. That is to say, that the quality is twice as good and the price is less than twice as much more than Bid C:

In summary, since June 2020, at the latest, it is no longer acceptable market practice to apply relative-scoring as part of the price evaluation where you are awarding contracts on the basis of best “price-quality ratio”. In the light of that it is interesting to note that central government departments and agencies, including the OGC and MoD have, almost a year later still not changed their bid evaluation methodologies to reflect government guidance. You can find out more here.

Contact us

To discuss any of the above or to consider more general commercial assistance please contact Uddalak Datta or another member of the commercial team.

Our updated guide to recovery and resilience covers everything you need to navigate your business out of lockdown, unlock your potential and make way for a brighter future. Further advice in relation to COVID-19 can be found on our dedicated coronavirus resource hub.

From inspirational SHMA Talks to informative webinars, we also have lots of educational and entertaining content for life and business. Visit SHMA® ON DEMAND.

Get In Touch

Udi has a wide commercial background working in-house and for clients in highly regulated sectors.

His experience ranges from advising on PFI/PPP projects, joint ventures and collaboration agreements, through to distribution agreements and consumer contracts.

Udi has had experience working with clients as an in-house lawyer and brings a professional, pragmatic and pro-active approach to his work.

Written By

How We Can Help

Commercial Contracts

Commercial contracts will underpin many of your trade arrangements with other businesses and jurisdictions on a domestic and international level. Our team of experts work with you to ensure your commercial contracts are supporting your business ambitions, not working against them, during this uncertain period.

Our Latest Corporate & Commercial Updates

13 May

Corporate & Commercial

Evaluating Price in Tenders – new guidance on new practices

Our experts are here to answer any questions you might have

If you’d like to speak to a member of our team, please fill out the enquiry form. We will aim to reply to your query within 2 hours

Need to talk to someone sooner? You can call use at the number below